maricopa county tax lien foreclosure process

You must have registered separately for the Tax Lien Web feature. These listings may be used as a general starting point for your research.

Pursuant to this legislation tax liens eligible for expiration will include the original certificate and all related sub taxes in the expiration process.

. For more assistance with your research please speak with an Information or Reference Services staff member. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus.

Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Maricopa County CA tax liens available in CA. SELECTED LAWS REGULATIONS AND ORDINANCES.

The Clerk of the Board will prepare a quit claim deed record that deed with the County Recorder and then issue the deed to the new parcel owner. Maricopa County County AZ tax liens available in AZ. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales.

Shop around and act fast on a new real estate investment in your area. Maricopa County AZ currently has 22642 tax liens available as of February 14. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

This process takes approximately 2 weeks from Board approval. Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value. At least 30 days before filing for foreclosure complaint you must send notification to the following addresses of your intent to foreclose.

8am - 5pm Monday - Friday. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale. What is the tax deed process.

After three years from the date of the tax lien sale but no later than 10 years the CP holder may begin a judicial foreclosure action to obtain ownership of the property. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. The attorneys here have been involved with a form of Arizona real estate investment known as Certificates of Purchase CP or real property tax liens for the past twenty-four years.

For example Maricopa County conducts its on-line auction in February of each. The property owner of records of the Mohave County Recorder according to the county recorders records OR. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor.

Next enter your buyer number click the Register Here button and follow the prompts to. Durango St Phoenix Arizona 85009. Delinquent and Unsold Parcels.

Arizona statute requires that a Notice of Intent be sent out at least 30 days and no more than 180 days before a Complaint is filed attempting to foreclose the tax liens. To obtain the deed on your tax lien certificate you must follow a three step process. If you have not yet registered start by pressing the Tax Lien Web button on the Treasurers website home page in the Investor section.

Shop around and act fast on a new real estate investment in your area. Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

2a The property owner according to the records of the Mohave County Assessor and. Shop around and act fast on a new real estate investment in your area. Judicial foreclosure involves filing a lawsuit with the court to obtain a court order to foreclose.

Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including the state a deed conveying the property described in the Maricopa County Arizona tax lien certificate Sec. Those liens with deadlines that are already in effect will not be affected however it will affect all future sub taxing liens so that the deadline will expire within a ten year period after the last day of the month that it was acquired and time. Maricopa AZ tax liens available in AZ.

Except Federal Holidays Customer Service. The above parcel will be sold at Public Auction on Monday June 27 2022 at 1100 am Flood Control District of Maricopa County 2801 W. Every year the counties have auctions to sell these unpaid property tax liens.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. The first step is to send a 30 day demand letter that meets all of the statutory requirements.

In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest. Judicial Foreclosure The judicial process of foreclosure is now required for tax lien holders. All groups and messages.

The notice is required to be sent to the the situs address of the property each of the owners of record and the county treasurer via Certified Mail. TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library. What is the process to foreclose my tax lien.

Find the best deals on the market in Maricopa AZ and buy a property up to 50 percent below market value. Prior to initiating the court action the CP holder is required to give the property owner a minimum of thirty days notice by certified mail of the impending foreclosure. Buyers must be aware that all parcels are sold as is.

We can help you draft a demand and send a demand letter that meets all of the statutory requirements. No warranties are made concerning the parcel or its suitability for use. A cashiers check in the amount of 1108000 made out to Flood Control District of Maricopa County is required to be an eligible bidder.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

Wall Street Quietly Creates A New Way To Profit From Homeowner Distress Center For Public Integrity

Wall Street Quietly Creates A New Way To Profit From Homeowner Distress Center For Public Integrity

Does Arizona Have A Real Estate Transfer Tax The Arizona Report

Buying Tax Deeds In Florida How To Get Florida Real Estate For 10 20 Or 30 Cents On The Dollar Tax Lien Certificates And Tax Deed Authority Ted Thomas

Buying Tax Deeds In Florida How To Get Florida Real Estate For 10 20 Or 30 Cents On The Dollar Tax Lien Certificates And Tax Deed Authority Ted Thomas

Does Arizona Have A Real Estate Transfer Tax The Arizona Report

Maricopa County Assessor S Office

Buying Tax Deeds In Florida How To Get Florida Real Estate For 10 20 Or 30 Cents On The Dollar Tax Lien Certificates And Tax Deed Authority Ted Thomas

Buying Tax Deeds In Florida How To Get Florida Real Estate For 10 20 Or 30 Cents On The Dollar Tax Lien Certificates And Tax Deed Authority Ted Thomas

Buying Tax Deeds In Florida How To Get Florida Real Estate For 10 20 Or 30 Cents On The Dollar Tax Lien Certificates And Tax Deed Authority Ted Thomas

Maricopa County Assessor S Office

Conspiracy Driven Demonstrators Protest Election In Maricopa County Phoenix New Times

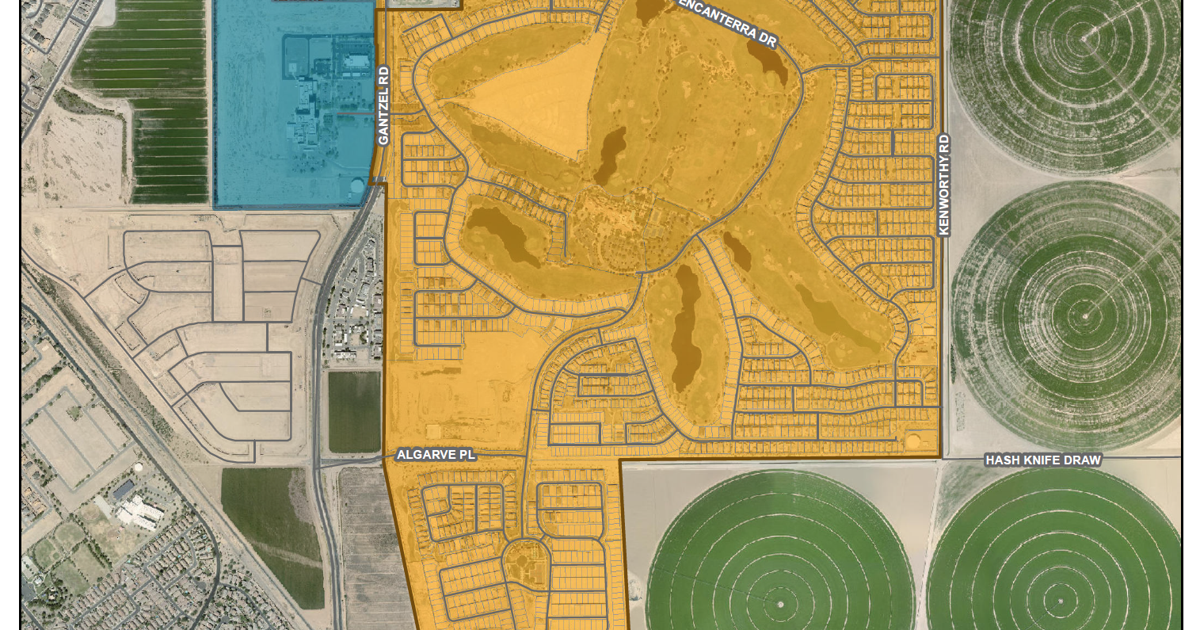

Encanterra Residents Split On Queen Creek Annexation Local News Pinalcentral Com